idaho state capital gains tax rate 2021

For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income. Zero percent 15 percent or 20 percent.

Leuven Named The 2020 European Capital Of Innovation Baltimore Independent

Long-term capital gains come from assets held for over a year.

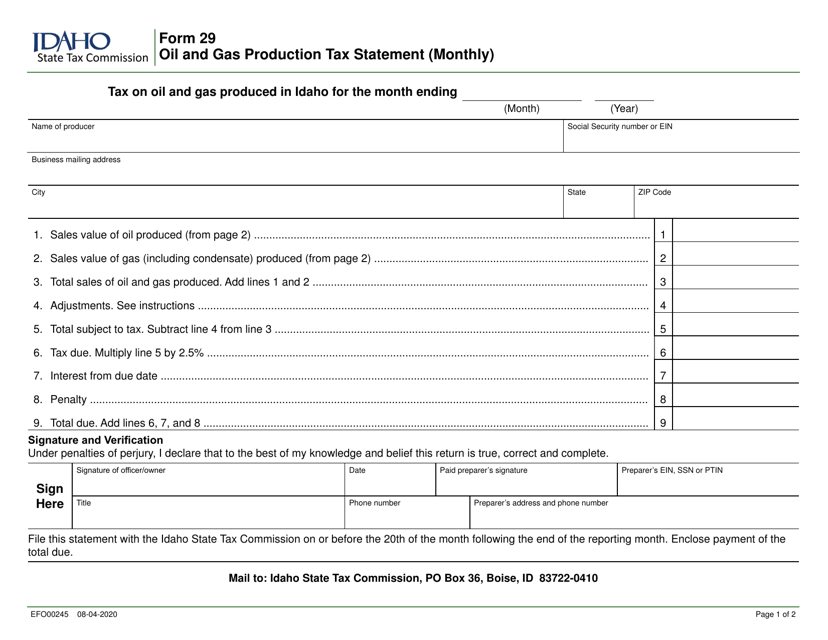

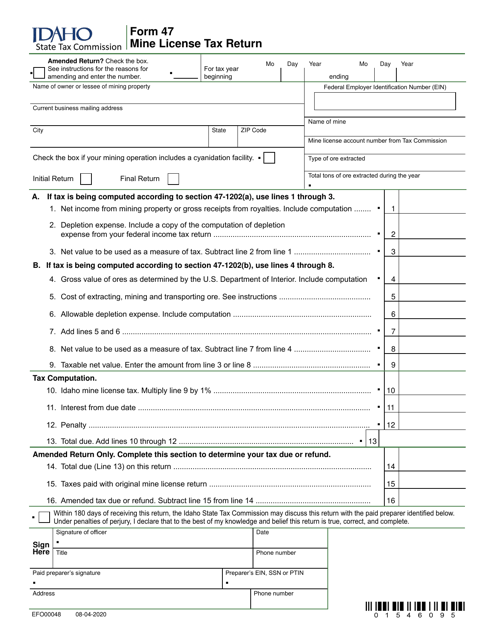

. Capital Gains Tax in Idaho. Idaho State Tax Commission. Idaho tax forms are sourced from the Idaho income tax forms page and are updated on a yearly basis.

Taxes in Idaho. How does Idaho rank. Lower tax rates tax rebate.

Each states tax code is a multifaceted system with many moving parts and Idaho is no exception. In May 2021 Idaho Governor Brad Little signed into law HB. Maximum capital gains tax rate for taxpayers with income above 459750 for single filers 517200 for married filing jointly.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. House Bill 317 Effective January 1 2021.

Page 1 of 2. The capital gains rate for Idaho is. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Idaho doesnt conform to bonus depreciation for assets acquired after 2009. Short-term gains are taxed as ordinary income. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets.

The first step towards understanding Idahos tax code is knowing the basics. The corporate income tax rate is now 65. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

The Idaho tax rate is unchanged from last year however the income tax brackets. The idaho state sales tax rate is 6 and the average id sales tax after local surtaxes is 601. The percentage is between 16 and 78 depending on the actual capital gain.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. The tables below show marginal tax rates. Also some Idaho residents will receive a one-time tax rebate in.

Home capital idaho rate tax. 380 which effective retroactive to January 1 2021 lowers the top personal income tax rate from 6925 to 65 reduces the income tax brackets from seven to five and provides Idaho income taxpayers. Plus 6625 of the amount over.

Plus 5625 of the amount over. Individual income tax rates now range from 1 to 65 and the number of tax brackets has been reduced from seven to five. For individual income tax rates now range from 1 to 65 and the number of tax brackets dropped from seven to five.

Farm capital gains is very complicated. But the tax rates are not. The 2022 state personal income tax brackets are updated from the Idaho and Tax Foundation data.

The general capital gains tax rate for the farm is 15 federal. Maximum capital gains tax rate for taxpayers with income above 41675 for single filers 83350 for married filing jointly. Plus 3625 of the amount over.

Idaho state capital gains tax rate 2021 Sunday February 27 2022 Edit. This means that different portions of your taxable income may be taxed at different rates. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property.

Defining Your Coast Level Retirement Savings Saving For Retirement Retirement Money Retirement With Rbi Keeping Interest Rates On Hold Quantitative Easing To Unfold Fitch Times Of India In 2021 Bank Of India Times Of India Icici Bank. For example a single. Additional State Capital Gains Tax Information for Idaho The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

Idaho state income tax rate table for the 2020 - 2021 filing season has seven income tax brackets with ID tax rates of 1125 3125 3625 4625 5625 6625 and 6925 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. EFO00093 09-15-2021 Form CG Capital Gains Deduction 2021. Tax Rate.

2021 federal capital gains tax rates. Idaho has enacted several tax cuts in the past decade lowering rates for top earners from a rate of 780 in 2011 down to the current rate of 650 for the 2021 tax year. The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates.

Tax Rate Reduction Effective January 1 2021 all tax rates have been decreased. Idaho law adjusts 2021 personal income tax rates and brackets revised 2021 income tax withholding tables issued. Idaho conforms to the IRC as of January 1 2021.

Even with these tax cuts that remains on the higher side of all the rates in the country. Below we have highlighted a number of tax rates ranks and measures detailing Idahos income tax business tax sales tax and property tax. The Idaho State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Idaho State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

The Idaho Department of Revenue is responsible for publishing the latest Idaho State. Short-term capital gains come from assets held for under a year. Installment sale isnt eligible for the Idaho capital gains deduction if the property wasnt held for the.

During the waning days of the 2021 legislative session lawmakers altered the ability of municipalities to adjust their budgets based on new growth. Idahos income tax rates have been reduced. Capital Gains Deduction and Instructions 2021 approved Author.

Plus 1125 of the amount over. Plus 4625 of the amount over. Plus 3125 of the amount over.

Historical Idaho Tax Policy Information Ballotpedia

Historical Idaho Budget And Finance Information Ballotpedia

Idaho State Department Of Agriculture Announces Approved State Hemp Plan Idaho Bigcountrynewsconnection Com

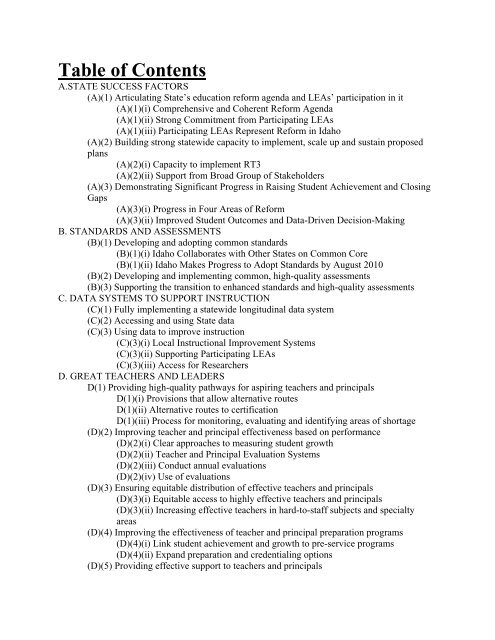

Out Of Many One Idaho State Department Of Education

Idaho Student Loan Forgiveness Programs

Where S My Refund Idaho H R Block

Idaho Income Tax Calculator Smartasset

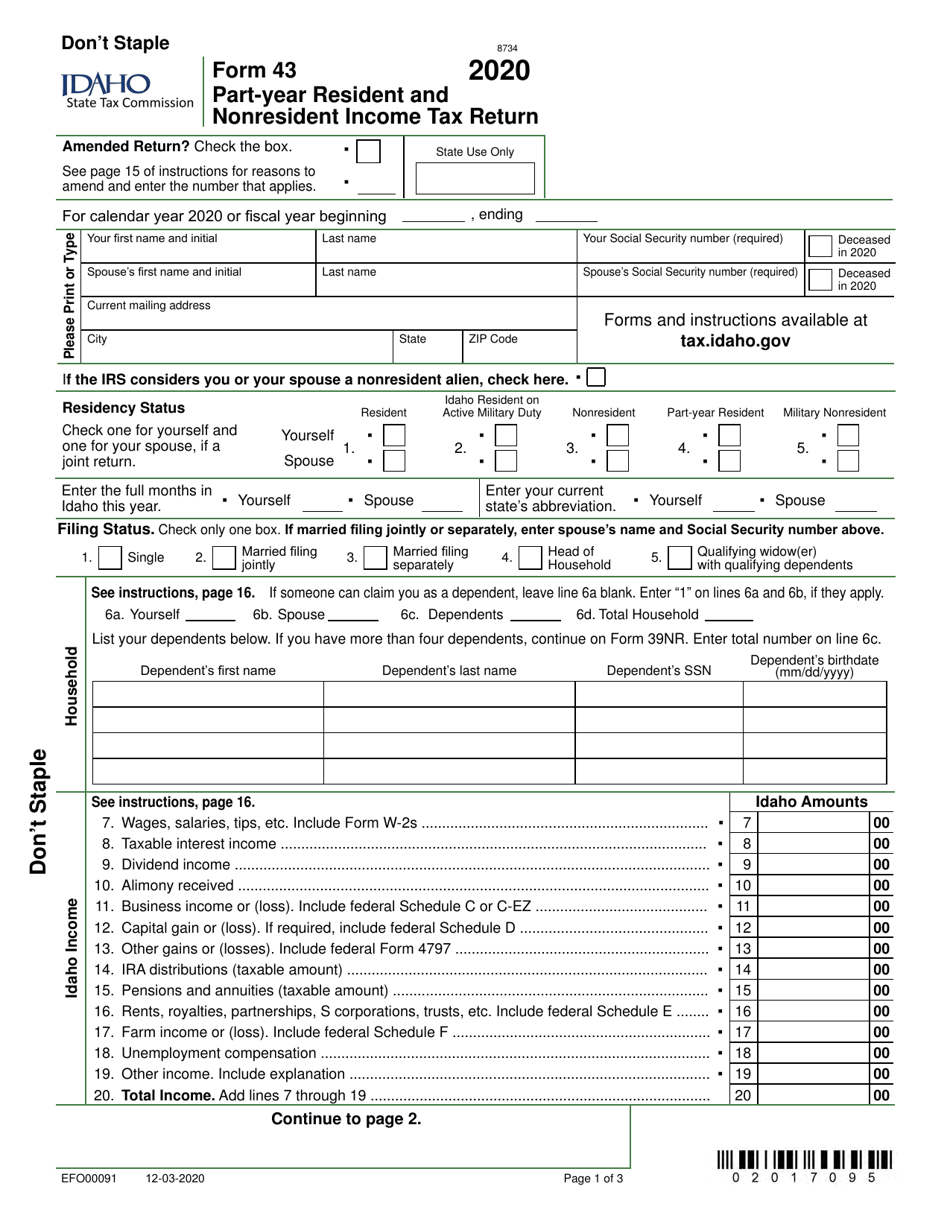

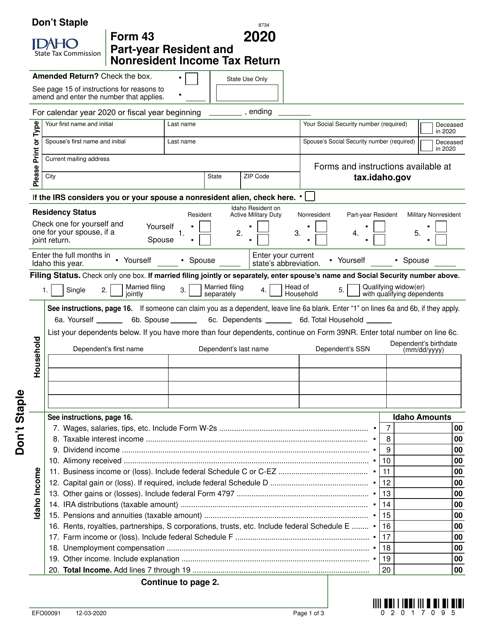

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

Idaho Blue Book Parent Directory Idaho Statesman

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Idaho Tax Forms And Instructions For 2021 Form 40

Prepare And E File 2021 Idaho State Individual Income Tax Return

Idaho Income Tax Calculator Smartasset

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Idaho Senate Passes 600 Million Income Tax Bill Without Grocery Tax Repeal Amendment Idaho Capital Sun

Idaho State Tax Software Preparation And E File On Freetaxusa

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Idaho State Senator Floats Plan That Would Eliminate School Supplemental Levies Idaho Capital Sun